What the Wilson County Sales Tax Referendum means to your pocket and county funding.

During the March 3rd election, you will have the opportunity to vote for or against increasing Wilson County’s sales tax. Before you head to the polls, I want to make sure you have as much information as possible so you are able to make an educated decision at the ballot box.

Early voting begins on February 12th and ends on February 25th. There are six polling places that will be open during early voting and you can find the full list including addresses here. In addition, you can see sample ballots here.

Sales Tax Resolution History

Over the summer (2019), Wilson County Schools asked the county commission for funding to increase teacher salaries. The raises would have required approximately $4,000,000 in additional funds, which would have required a tax increase. Commission constituents were clear and did not support a property tax increase to fund the raises, so the county commission passed a status quo budget. You can read more here.

After the current budget was passed in August (2019), the need for teacher raises was still a topic of discussion the majority of commissioners were hearing on a regular basis. So, the county commission passed a resolution in November so voters could decide if they wanted to fund teacher raises with an increase in the county sales tax rate. That is what you will be voting to decide in the next month.

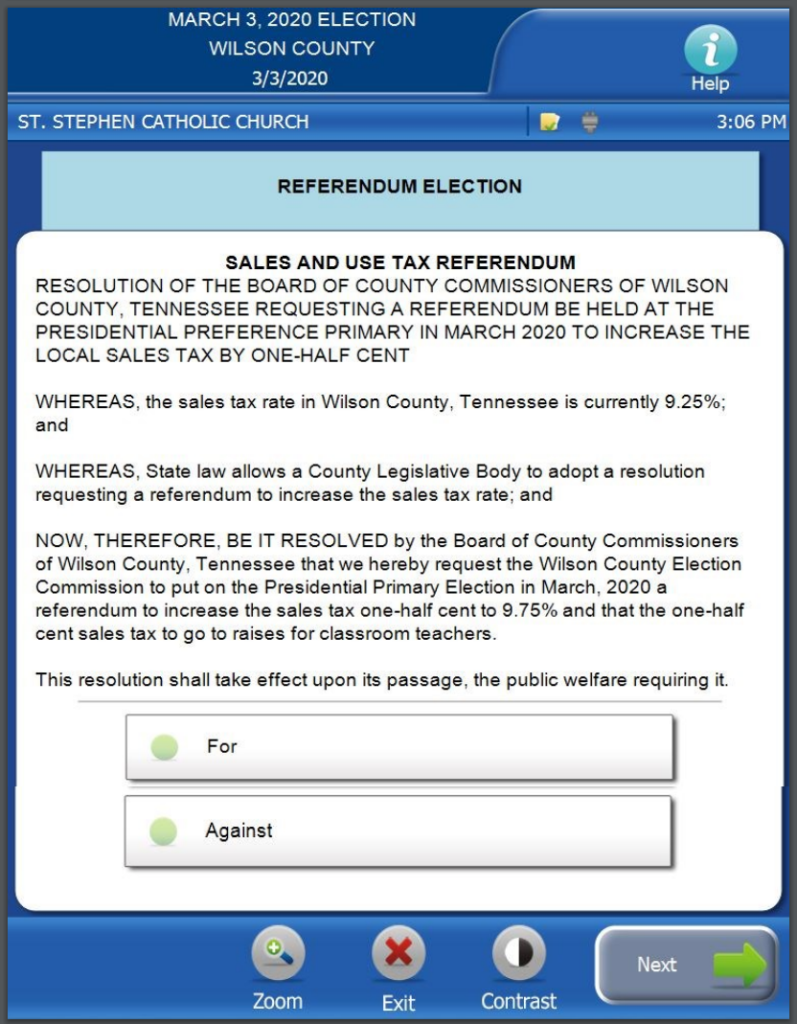

Sales Tax Sample Ballot

Here is the wording on the ballot that you will see when you vote:

A Breakdown of the Sales Tax Rate

Sales Tax rate of 9.25%

Currently, when you purchase an item in Wilson County, you pay 9.25% sales tax. Seven percent goes to the State of Tennessee. The remainder (2.25%) is called the Local Option sales tax and it is split in half. Half of the local option goes to fund education and the other half goes to the municipality where the purchase was made.

For example, if you buy something in the city of Mt Juliet, your sales tax would be broken down like this:

- 7% to the State of Tennessee

- 1.125% to the city of Mt Juliet

- 1.125% to fund education in the county (both WCS and LSSD get a portion)

If you buy something in Lebanon, your sales tax would be broken down like this:

- 7% to the State of Tennessee

- 1.125% to the city of Lebanon

- 1.125% to fund education in the county (both WCS and LSSD get a portion)

If you buy something in Watertown, your sales tax would be broken down like this:

- 7% to the State of Tennessee

- 1.125% to the city of Watertown

- 1.125% to fund education in the county (both WCS and LSSD get a portion)

If you buy something in Wilson County outside of any city limits (outside Mt Juliet, Lebanon, Watertown):

- 7% to the State of Tennessee

- 1.125% to Wilson county

- 1.125% to fund education in the county (both WCS and LSSD get a portion)

Sales Tax rate of 9.75%

If the resolution to increase sales tax passes, the distribution of the funds would be:

- 7% to the State of Tennessee

- 1.375% to the city or county where the purchase was made

- 1.375% to fund education in the county (both WCS and LSSD get a portion)

What a 0.5% Sales Tax Increase Would Mean to You

If the sales tax increase passes it would increase the cost of purchases by 5 cents (one nickel) for every $10 you spend.

Revenue Generated by a 0.5% Sales Tax Increase

If the sales tax increase passes, the increase will generate an additional:

- $5.2 million for Wilson County Schools

- $910,000 for Lebanon Special School District

- $2.3 million for the City of Mt Juliet

- $2.8 million for the City of Lebanon

- $44,000 for the City of Watertown

- $465,000 for Wilson County

Teacher Raises

Per the resolution, the educational portion ($5.2 million for WCS and $910,000 for LSSD) would be spent on classroom teacher raises.

Frequently Asked Questions

Here are some of the questions I have seen asked, along with answers.

What is the definition of a “classroom teacher”?

The county commission passed the sales tax referendum specifically for classroom teacher raises. Wilson County schools then provided the following definition to clarify the meaning of “classroom teacher.”

All Certified staff, with the exception of assistant principals, principals. coordinators, directors, supervisors, Deputy Directors, and Director of Schools, will receive a pay increase if the proposed sales tax is passed.

– Wilson County Schools

What are the other options to fund teacher raises?

Under Tennessee law, there are essentially 3 options to generate money for educational operations: property tax, wheel tax, and the sales tax. We chose the sales tax for three primary reasons. First, the sales tax must be approved by referendum, so you get a choice. Second, by law, half of the revenue is required to go to education with the other half going to the city where the sale originated….without exception. This money cannot be diverted to other county needs in the future. By law, it will always go to fund education, and more specifically, to teacher salaries. Finally, the sales tax is the only tax that allows us to capture a large percentage from people outside of Wilson County.

It is estimated that 30% of the revenue collected will come from non-Wilson County residents, thereby lowering the burden on our citizens. As a point of reference, to generate the same amount of revenue would require a 13.5 cent increase in the property tax rate or a $33 wheel tax, with all the additional revenue coming from Wilson County residents.

– Aaron Maynard, Wilson County Finance Director

How Do I Know the Board of Education will use these funds for teacher raises?

The education portion of the revenue from the proposed half-cent sales tax increase will be designated to fund salary increases for classroom teachers. The sales tax referendum provides the citizens of Wilson county with an alternative to raising the property tax rate in order to generate necessary revenue to cover this type of expense. The Wilson County Board of Education originally approved a resolution supporting the approval of the sales tax increase on October 1, 2018 and reaffirmed their position on November 4, 2019.

– Dr. Donna Wright, Wilson County Schools Director

LSSD has given raises for the last 25+ years and our portion of the 0.5% sales tax increase would be designated to raises

– Lebanon Special School District

Will the sales tax money be allowed to be shifted to another purpose two years from now?

The wording in the referendum guarantees the funding will go to teachers. Once the raises are in the budget, they have to be continually funded. This will be a raise, not a one time bonus, so the funding will be on going to fund the higher salaries.

– Chad Karl, Wilson County Board of Education

When was the last time taxes were raised for teacher raises? And did the teachers get their raises?

A property tax increase was passed in 2016 and part of the increase was to give raises to teachers. The teachers did receive a raise. Teachers with one to five years of experience were give $1,000; those with six to ten years of experience were given $2,000 and teachers with eleven years or more of experience were given a $3,000 raise.

Will the sales tax funds be used to increase teacher pay to a salary more competitive and will they receive this increase in addition to their annual merit raise?

If the sales tax referendum passes, we feel the projected salary increase will certainly place our teachers with 10+ years of experience in a more competitive position with peers in other districts. We have been at a disadvantage in not being able to move the veteran teachers faster, even after lifting the cap at 16 years when we added performance pay. Teachers will continue to earn their performance pay annually, in addition to any salary increase should the sales tax referendum be successful.

– Dr. Donna Wright, Wilson County Schools Director

Are teachers the only beneficiaries of the proposed sales tax increase?

Teachers in both WCS and LSSD will receive raises, but they will not be the only beneficiaries. If the referendum passes, cities in Wilson County (Mt Juliet, Lebanon, and Watertown) will also receive an increase in revenue. Speak to your city council person to find out their plans for the additional money if the sales tax referendum passes.

What is the sales tax in surrounding counties?

Click here to see the current sales tax rates (per the Tennessee Department of Revenue) in Tennessee Counties and cities.

Is the $33 wheel tax increase an option? It seems $33 is a much cheaper option per individual to accomplish the same end result.

Hi Lori, The commission has not discussed increasing the wheel tax.

This is the only fair tax for our citizens. This way everyone shares in paying. Teachers need better pay. Our county and city need this in order to keep our teachers in our county.

Why not use the other half going to cities and counties to give our public safety personnel a much needed more competitive salary. Lebanon Fire and PD, Mt Juliet Fire and PD Wilson SO and WEMA. Probally make to much since you use the additional income for raising other ppl salaries who don’t even compare to other counties but put thier lives on the line daily for the commissioners and citizens alike

The other half is controlled by the city in which a purchase is made, so the cities would have to make that decision. Contact your local city commissioner to find out their thoughts on what the additional revenue would be used for.

Also a sizable portion of this tax will be paid be people living outside the county when they are shopping or visiting

How much would each teacher receive with this raise?

My understanding is the school board will institute the raises that were proposed this past August. It was based on tenure – teachers with 1 – 5 years with the county would get $1000, 6 – 10 years would get $2000, 11 – 15 years would get $3000, 16 – 20 years would get $4000 and those with 21+ years would get $5000. Then they would also get their annual merit raise.