The main mission of the Wilson County Commission is to create and manage the county budget. The dollars in the budget fund schools, the Sheriff’s department, Wilson Emergency Management Association (fire and ambulance services), roads, the County Court system and much more.

All these services and departments are funded locally through four main sources of revenue.

Property Tax (Local Taxes)

Property taxes are the primary funding source for the County. The county budget is based on a July 1 to June 30th fiscal year. That means every year the budget starts over the first of July. The property tax rate is set annually based on the needs of the county.

In the 2021/22 budget year (FY2022), a penny of property tax raises $595,000 in revenue. This number changes annually based on the value of the property in the county. Higher property values raise more money per penny. You can compare what a penny of tax raises to other counties in the annual Tennessee County Tax Statistics that are published through the University of Tennessee. Table 3 in each of the annual documents shows how much a penny of property tax raises in each of Tennessee’s 95 counties.

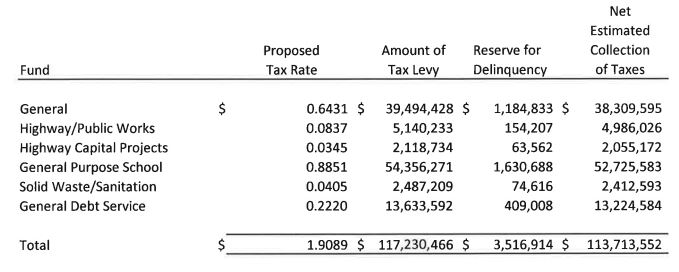

The FY2022 budget set the property tax rate at $1.9089. Below is a table to show how that money is distributed:

How to Calculate Your Property Taxes

Homes in Wilson County are appraised every five years. The tax rate is applied to 25% of the value of a home, divided by 100. You can read about how the calculation is determined on the Tennessee State Comptroller’s website. Here is an example for Wilson County:

If your home is valued at $250,000 then the assessed value of your home is $62,500 (25% of $250,000). The tax rate for Wilson County is $1.9089 per $100 of assessed value. So, to figure out the tax bill, divide the assessed value by 100 and then multiply by the tax rate:

$62,500/ 100 = 625 x $1.9089 = $1193.0625 total annual tax bill

In this example, a penny of property tax costs the homeowner $6.25 per year.

Wheel Tax

The wheel tax is collected annually when you register your vehicle. It is currently a $25 annual fee in Wilson County. The County has approximately 127,240 registered vehicles which resulted in $3,180,998 in actual revenue for FY2021.

The money collected through the wheel tax goes to pay for the general debt service fund (Fund 151), which is where the county accounts for long term debt from bonds. These bonds are issued to borrow money for large projects. Wilson County’s bonds are primarily used to build schools. Basically, the county uses bonds to build schools like an individual would get a mortgage to buy or build a house.

Sales Tax

As we all know, this is the tax that is collected any time you make a purchase. The sales tax is 9.75% in Wilson County. 7% of that goes to the state of Tennessee, leaving 2.75% as the local option sales tax.

That 2.75% is split with half going to the municipality where the purchase was made (Mt Juliet, Lebanon, Watertown, etc.) and the other half funds education. The education portion is split between Wilson County Schools and Lebanon Special Schools.

Wilson County voters increased the sales tax from 9.25% to 9.75% in March of 2020. The educational portion (0.25%) is used to provide teacher raises and is restricted by the resolution passed to fund teacher salaries. Click here to read more about the March 2020 sales tax referendum.

Adequate Facilities Tax

The adequate facilities tax is a one time fee on newly built residences. It is currently $5000 per residence, including individual homes and individual condo or apartment units. As it is a one time fee and not recurring revenue, AFT is used for capital expenditures. Two-thirds of the funds are used for debt service (Fund 151) and one-third is used for shorter term capital projects (Fund 189).

Revenue from the State of Tennessee

Gas Tax

The gasoline tax is used to fund highway, public works, and road maintenance and construction costs.

Basic Education Program

The majority of the revenue that Wilson County receives from the state is from the Tennessee Basic Education Program (BEP) which funds schools. The BEP is a significant portion of the state’s budget and each county gets a different amount. You can use the BEP calculator on the Controller’s website if you are interested in learning more about the BEP and how Wilson County’s funding is determined.

The Tennessee Legislature is currently (Feb. 2022) considering a new funding formula, so this may change in the near future.

Additional State Revenue

The county also receives state funding for the county health department, for the contracted prisoner board, as well as dollars for small programs like litter control. The county receives money as part of its share of state profits from TVA. There are also some small grants.

Revenue from the Federal Government

Federal money is allocated for specific programs including schools and law enforcement.

Other County Revenue Sources

Wilson County earns revenue though other sources, but these sources do not generate as much as the specific taxes and state and federal funding I’ve outlined above. These include court fees, fees for licenses, the county hotel/motel tax, and other smaller taxes and fees for county services.

If you are interested, the full county budget is available online – just click HERE. The County Commission will be working on the budget for the 2022/23 fiscal year over the next several months using the revenue collected to fund all the county departments and services that make Wilson County a great place to live.