A news article was recently published about the annual audit of Wilson County’s finances done by the Tennessee state Comptroller. It was entitled “State audit finds sloppiness in county finances.” While there were several findings, the errors were not cash transactions; there were no assets missing. The errors were all related to accounting presentation standards.

As you all know, I treasure transparency, and it is very important to me that citizens of Wilson county understand the county budget, the audit, and the process that goes into county financial management.

In addition, the county commission has a meeting with the audit committee (part of the county commission), the county finance director, and the auditors from the Tennessee State Comptrollers office every year to go over the findings. The meeting is open and allows county government officials and the public to hear about any findings directly from the Comptroller’s office. The finance director can also address any findings and explain what happened and what will change to ensure a finding doesn’t occur again. If you are interested in more information about the audit and the findings, the meeting will be scheduled soon and the date and time will be on the calendar on the Wilson County website.

With this in mind, I would like to provide some clarifications about the 2020 Wilson County Audit findings.

Auditors Issued an Unmodified Opinion

First, it is important to note, the Audit results state, “Our report on the financial statements of Wilson County is unmodified.” This statement is on page 312 of the audit document.

What exactly does “unmodified” mean? The International Federation of Accountants provides a definition in the International Standards of Auditing.

The auditor shall express an unmodified opinion when the auditor concludes

International Standards of Auditing (https://www.ifac.org/system/files/downloads/a036-2010-iaasb-handbook-isa-700.pdf Pg. 5/29 in the pdf document)

that the financial statements are prepared, in all material respects, in accordance

with the applicable financial reporting framework

This means, the Auditor concluded the financial statements were presented fairly, and according to accounting standards. The goal of an audit is to earn an unmodified opinion, which is the result of Wilson County’s audit.

Findings

There were five findings in this year’s audit. All have been addressed and rectified and a plan has been put into place to ensure they do not occur again.

The article in the Wilson Post starts with a statement that the accounting errors totaled nearly $14 million. It makes it sounds like the county lost $14 million dollars or can’t account for the money. That is NOT true. The errors were not cash transactions. The author went through the five findings and added together any number that was mentioned in the finding, ignoring the context and explanation. Here is how she got to “nearly $14 million” :

- $908,364 – adjustments made in the general ledger account balances in the General Fund to make the books balance

- $250,000 – budget (not cash) entry error moving funds from one internal account to another

- $740,794 – understatement of revenues due to debits/credits posted backwards in the accounting records because of incorrect entries in a new computer system

- $4,685,534 – the amount the two reports for fixed assets generated by Skyward were different in the 2019 audit

- $7,493,060 – the amount the two reports for fixed assets generated by Skyward were different in the 2020 audit

- $35,652 – penalty and interest paid to the IRS by the Register of Deeds office due to unreported W-2s from the 2012 tax year (before the current register worked in the office)

The county’s total budget for FY 2020 was just shy of $300,000,000. If you factor in all the numbers above, that results in a 4.69% variance, which were all errors in account records, not errors in actual cash transactions and all assets were accounted for.

Below are the findings and a full explanation of what happened along with the corrective action. I’ve listed page numbers in the audit, in the explanations below so you can read the text I refer to. Here is a link to the audit document:

https://comptroller.tn.gov/content/dam/cot/la/advanced-search/2020/county/FY20WilsonAFR.pdf

Finding 2020 – 001 Audit Adjustments in the General Fund

The first finding stated, “certain general ledger account balances in the General Fund were not materially correct, and audit adjustments totaling $908,364 were required for the financial statements to be materially correct at year-end.” (pg. 313)

The $908,364 total came from two situations. The first was a math error from FEMA and TEMA reimbursements received by Wilson County to cover expenses incurred because of the tornado that hit the county in March. The math error totaled $468,579. The second error was for the once yearly ambulance receivable calculation and had to do with how deferred revenue is handled. It was a total of $440,055.

The audit goes on to find, “Material audit adjustments were required because the county’s financial reporting system did not prevent, detect, or correct potential misstatements in the accounting records. It is a strong indicator of a material weakness in internal controls if the county has ineffective controls over the maintenance of its accounting records, which are used to prepare the financial statements, including the related notes to the financial statements. This deficiency is the result of a lack of management oversight. We presented audit adjustments to management that they approved and posted to properly present the financial statements in this report.”

Put another way, math errors were made, and there wasn’t someone who was tasked to double checked the work, so the errors were not caught. The corrective action plan (pg. 319) is to ensure that all calculations going forward will be done by one employee and then checked by another employee.

Budget Timeline

The article published in the Wilson Post states, “Maynard didn’t submit the county’s budgets on time, the report said. They are required no later than Sept. 30. Wilson County submitted budgets on Oct. 6.”

This statement is incorrect – first, per TCA code, unless a continuing resolution is filed by the county (which until 2020 was standard practice), the county budget is due to the Comptroller by Aug. 31st, not Sept. 30.

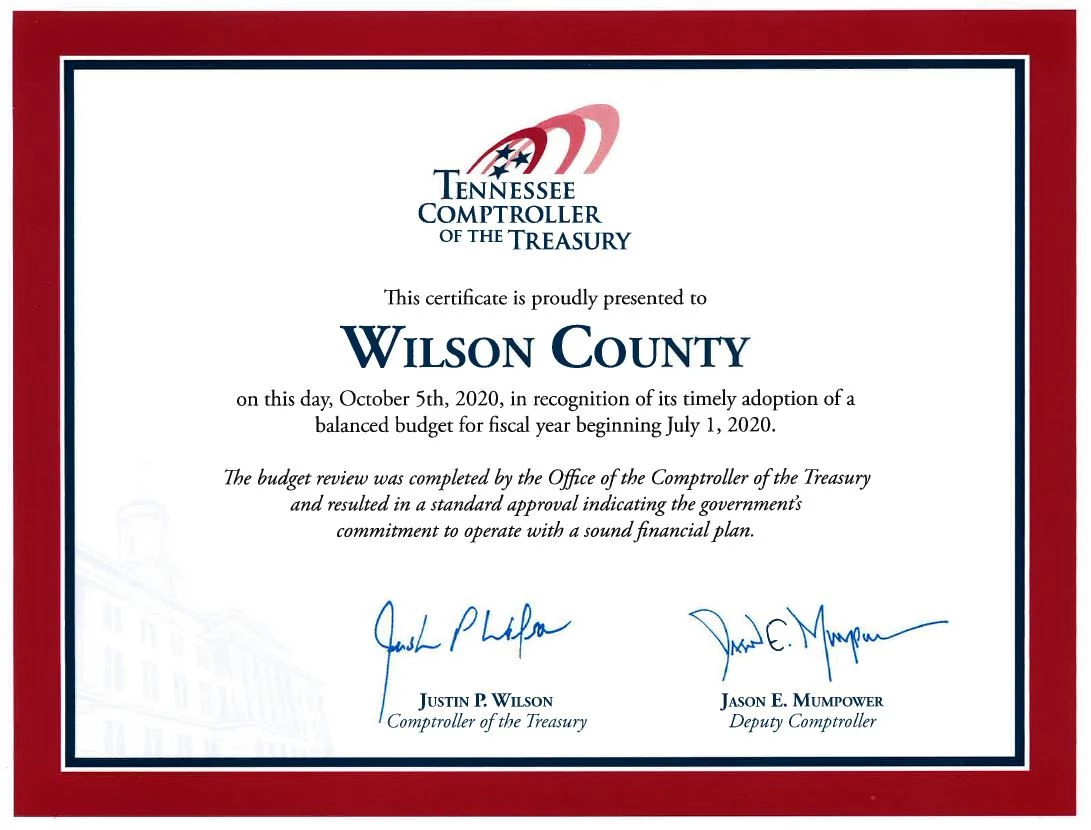

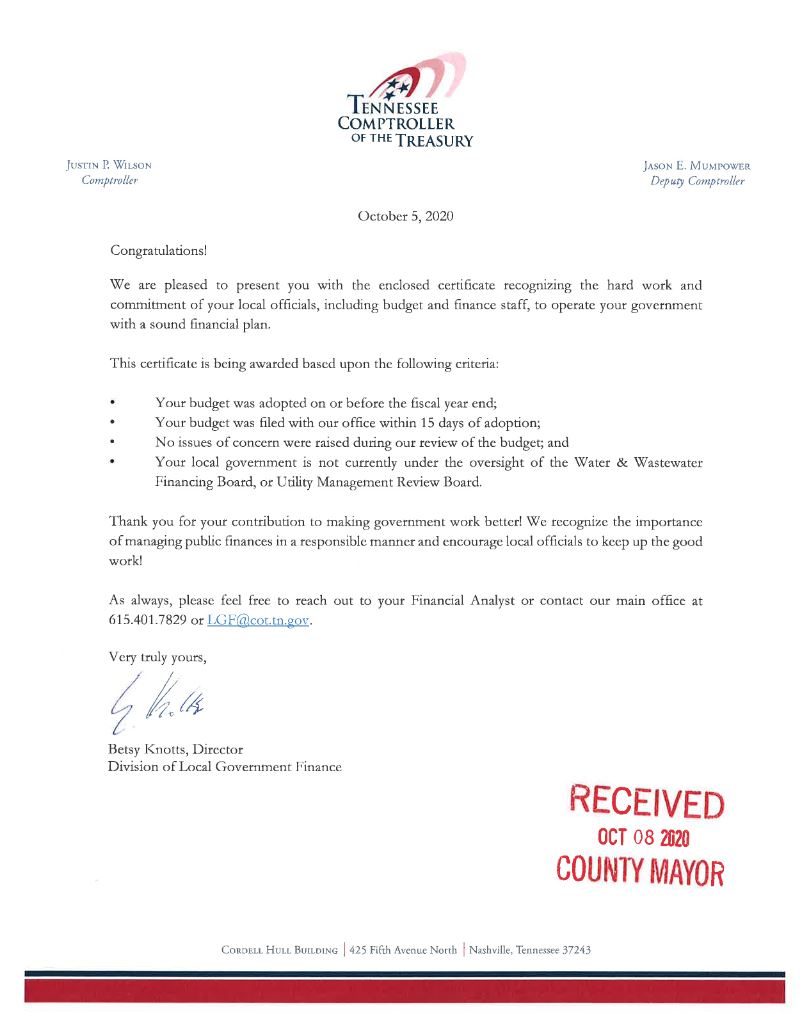

Secondly, Wilson County’s budget submission was not late; it was actually early. Wilson was recognized as one of 16 counties that received an award for turning budgets in at the beginning of the fiscal year (July 1).

Finding 2020 – 002 Accounting Records not provided on time

This finding is not saying the “budgets” were not turned in on time. What the finding refers to is the actuarial valuation of postemployment benefits (which is done by an outside actuary firm), capital asset records, and compensated absence records. (pg. 314)

This information was provided to the Comptroller at approximately the same time in 2020 as it has been in years past. What changed is Mr. Maynard is working toward a more comprehensive budget report, that when achieved, would be submitted to the GFOA for an award. When this was mentioned to the Comptroller, Wilson was moved to the first round of audits.

This is the first time Wilson has been in that group. Mr. Maynard was told that he had to have the books closed by July 23rd, which he did (hence the award above). What wasn’t mentioned was that the supplemental schedules also were supposed to be submitted earlier than in years past. If Wilson had not been moved to the first round of audits, then this would not have been a finding. Now that the new submission dates are clear, the county has moved to a different actuary to ensure the deadline is met going forward.

The corrective action plan for this finding (pg. 320), states that the county will contract with a different actuary firm, and the capital asset reporting and compensated absence reporting have been reassigned internally to ensure a more timely presentation.

Finding 2020 – 003 Budget Operation Deficiency

This finding (pg. 314) is split into two parts. The first finding (A) states the accounting records for the General Debt Service Fund was $250,000 less than approved by the county commission.

In most years, there is a transfer done that moves money from the county’s capital projects fund (189) to the county’s debt service fund (151) that is used to cover bond payments. In 2020, $1,000,000 was recorded as a debit in 189 and then $750,000 was recorded as the corresponding credit in 151. The county uses Excel to produce the budget document, and this was an entry error in Excel affecting the budget only.

The second finding (B) was caused by budget amendments related to revenue accounts were posted backwards in the budget accounting records. The finance office changed financial reporting software which functioned differently than the software previously used. There was a misunderstanding as to how budget amendments were processed in the system, which led to the error.

The corrective action taken (pg. 321) was to correct the misunderstanding on how the software functions. In addition, a more through system of monitoring changes to budget revenues has been adopted.

This finding was again, about a budget entry error; no cash or county assets were lost or not accounted for.

Finding 2020 – 004 Capital Asset Records

This finding (pg. 315) had to do with capital asset records and depreciation.

The finding stated:

The accounting software generates a report of capital assets by asset class and a separate

report by accounting function. The following deficiencies were noted:

A. Beginning balances in the report of capital assets by accounting function did

not agree with ending balances from the prior year by $4,685,534.

B. The June 30, 2020, report of capital assets by asset class and the report of

capital assets by accounting function failed to agree by $7,493,060.

C. Multiple issues were noted in accumulated depreciation, including assets not

being depreciated at all, assets depreciated more than they should be, and

assets being depreciated based on an incorrect acquisition date.

There are two reports generated from Skyward for fixed assets – one is a fixed asset report by function (general government, finance, administration of justice, public safety, etc.). The other is by asset class (land, building, machinery and equipment, etc.).

When the finance department produced the Fixed Asset By Function and the Fixed Asset Report By Class, the information wasn’t pulling into the report correctly from Skyward (the computer system). In the end, it was determined that the assets were in fact in the system and the auditors agreed.

The difference in the two reports was $4,685,534 for the FY 2019 audit and $7,493,060 for the FY2020 audit. The mismatched reports are from the software conversion to Skyward. Also as a result of the conversion, the 2019 depreciation amounts were overstated.

All the assets were accounted for, and the auditors agreed nothing was missing. In addition, depreciation is a reduction in value of an asset with the passage of time. It is a method of valuing physical assets (cars, equipment, computers, buildings, etc.), it is not a cash transaction.

Mr. Maynard fully explained the situation to the Wilson Post:

The issue began with a reporting financial software conversion that we did in October of 2018 (FYE 6/30/19). The fixed assets weren’t finished being converted to the new software until sometime early in FYE 6/30/20. When we realized we had a reporting problem, we brought in a consultant who was very familiar with old software and he worked with the new software company to fix the issues. It was reported back to me that the issues were resolved.

Depreciation reports are something that we generate once a year and only for the auditors. I didn’t follow up on the issue as I should have. When we generated the fixed asset reports for FYE 6/30/20, it became clear very quickly that the issue was not resolved as we had been led to believe. I stress that no fixed assets are unaccounted for.

We provided a reconciliation to the auditors that balanced beginning fixed assets. However, naturally the auditors want the system to generate the report without having to do a reconciliation. We are working with the software company to present the report in the proper fashion for audit. I have also begun using a second software package to track fixed assets independently of the financial reporting software as a check and balance of what that system is reporting. I am confident we are on top of the situation, but I do expect to have a prior period adjustment next year as we have noted an error in the depreciation calculations related to the conversion.

The corrective action (pg. 322), adds additional detail to the statement above. Again, to be clear, all fixed assets are accounted for and no cash transactions were involved.

Finding 2020 – 005 Register of Deeds Assessed an IRS interest and penalty payment of $35,652.91

This finding is fully explained in the audit (pg. 316):

During a previous register’s administration, Forms W-2 were not reported and filed with the Internal Revenue Service (IRS) for the 2012 calendar tax year. While the office was contacted multiple times by the IRS beginning in February 2014, the deficiencies were not addressed until the current register became aware in October 2019. The register of deeds was assigned an IRS tax advocate who investigated the case and ultimately ruled the interest and penalty

were owed. As a result, the IRS assessed interest and penalty totaling $35,652.91 that were paid February 2020. This deficiency resulted from a lack of management oversight.

The penalty was from 2012 (hence the interest), the only year there was an issue with reporting. It was before the current Register of Deeds, Jackie Murphy, worked in the Deeds office. Once the issue was brought to the current register’s attention, she addressed the issue, and it was rectified.

The corrective action plan (pg. 323) has already been implemented. The finance office is now in charge of payroll, instead of the Register of Deeds office.

Bond Rating

The county is in a healthy position financially. Wilson was just re-assessed by Standard and Poor’s and the county, was again, awarded an AA+ bond rating. There are only 2 counties in TN that are AAA. If Wilson was so financially sloppy, I don’t think there is any way the county could continually earn the second highest bond rating possible.

Finance Office

The Wilson county finance office is a lean operation with eight employees total, including director Aaron Maynard.

Three employees are dedicated to employee benefits and insurance. They handle paying insurance claims, administering the health insurance plan, and consulting with over 1,500 county employees and their dependents on health insurance. These three employees also manage worker’s comp claims and general liability claims.

The remaining five employees perform the duties for payroll, purchasing, risk management, write checks, monitor progress of actual results vs budget, consult with and advise:

- The County Mayor

- The County Commission

- Human Resources

- County Attorney (himself – he pays his staff)

- Election Commission

- Register of Deeds

- Planning

- County Buildings

- Building Codes

- Archives

- Finance (ourselves)

- Property Assessor

- County Trustee

- County Clerk

- Circuit Court Clerk

- General Sessions Judges

- Drug Court

- Clerk & Master

- Judicial Commissioners

- Probation

- Courtroom Security

- Victim Assistance Programs

- Sheriff’s Department

- Jail

- Workhouse

- Juvenile Services

- WEMA

- County Coroner/Medical Examiner

- The Health Center

- Animal Control

- The Wilson County Library

- Ag Extension

- Soil Conservation

- Storm Water Management

- Tourism

- Veteran’s Dept

- The Road Department

- The Ag & Expo Center

- Landfill and Convenience Centers

In addition, they also manage the county’s three debt service funds – General Debt, Rural Debt, and the Special Purpose Tax Fund.

The department uses Skyward for day to day operations, and budgeting for the county’s $448,572,031 (FY 2021) is done in Excel.

(As an aside, you may notice the drastic increase in the size of the budget from FY2020 to FY2021. The auditors decided that the School Capital Projects Fund should be presented in the budget. They had not taken that position previously. Obviously, when you are building as many schools as we have been in Wilson county due to the population growth, that adds a lot to the budget.)

Finance Director’s Reaction to the Findings

When Director Aaron Maynard, was asked about the findings, he sent this statement to the Wilson Post:

The total number of findings is surprising. We certainly attempt do everything we can during the year to try to prevent findings. As previously mentioned, sometimes we are led to believe a situation has been resolved only to find out it has not. Many of these are related to things such as software conversions. However, it is my responsibility to ensure that these are corrected and handled properly. And given that we had the issue described in #1, I am not taking anyone’s word that something has been corrected.

In other cases, like Finding 2020-002, we followed the same procedures we always have and have never received a finding. However, as an attempt to move this county forward in financial reporting we requested to provide an organization chart, letter of transmittal, and statistical section in our audit report. These are not required but are considered a best practice and are necessary for us to achieve the Government Finance Officers Association’s “Award for Excellence in Financial Reporting,” which we are working toward. As a result, the Comptroller moved us to a first-round county and everything has to be done faster as a first round county. We understood we had to have the books closed faster, but it was not well communicated to us that these other documents needed to be ready earlier as well.

Some of the required documents were not completely in our control (actuarial valuation of other postemployment benefits). But we have made moves to ensure that they will be available by August 31 for the current fiscal year.

Life is about continuous learning and improvement. So, we will learn from our mistakes and we will get better.

My Reaction, as Vice-Chair of the Finance Committee

As another commissioner expressed concern in the Wilson Post article, I will add that I am also concerned with the number of findings. It leads me to wonder, has the county provided the finance department all the resources needed to perform all the tasks and duties that are being asked of the department?

As I explained above, the errors are clerical in nature. With the current number of employees and systems in place, including budgeting in Excel, it is easy to understand how a mistake could be made. Is Excel the right system to manage the county budget? Would an additional person in the department help ease the work load?

The finance department is currently interested in transitioning from Excel to a budgeting system built specifically for local government budget management. In addition to tools for the finance department (and all the county departments) to produce and manage the budget, the system also provides easy to access information for the public to see the budget providing additional transparency. You can read more, and see examples of the budget documents and insights the system produces, at Cleargov.com.

I hope this article has brought some clarity and better understanding of the 2020 Audit. If you have further questions, please ask. Additionally, consider attending the annual Audit committee meeting that I mentioned, here again is a link to the county calendar.